Name:HENAN GUANGDA TEXTILES IMP. & EXP. CO., LTD.

Add:10/F,XinMangGuo Building,No.9 Business Outer Ring Road,ZhengDong New District,ZhengZhou,China

Tel:86-371-60170260

Fax:0371-60136222

Postcode:450000

Web:www.hngdtex.com

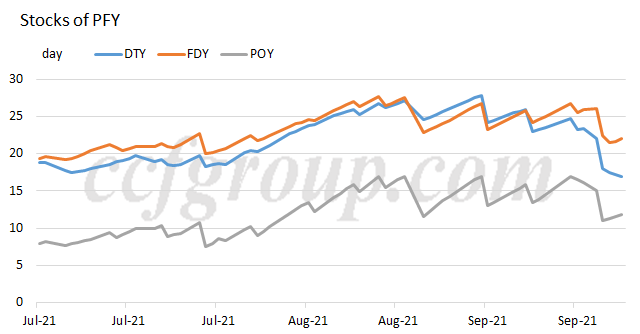

Sep and Oct are supposed to be traditional peak season in domestic market. Demand improved on the month in Sep, while supply substantially slipped impacted by the intensified control of energy consumption. The disparity between supply and demand resulted into falling stocks and increasing price on the whole polyester value chain. Twisting, water-jet fabric manufacturing and printing and dyeing sectors, which were heavily regulated by energy consumption, saw bigger price uptick or inventory reduction. Production enterprises witnessed hiking cost of raw material and accessories after coal, crude oil and natural gas prices soared. They raised price to transfer higher cost to downstream buyers.

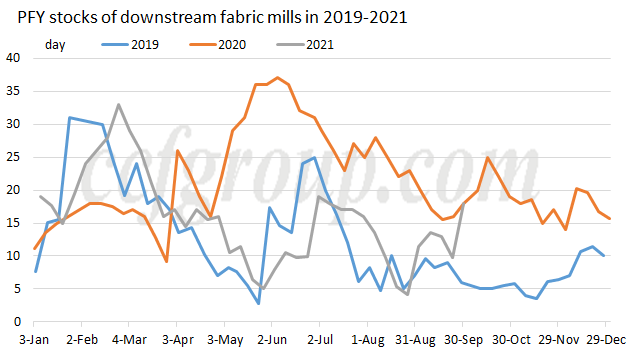

Speculative demand released with increasing price and falling stocks. The PFY stocks of downstream plants apparently rose. PFY producers also saw reducing inventory.

In addition, polyester products faced recovering cash flow and improving market fundamentals. Downstream demand has improved slightly since Q3. That means the polyester polymerization rate may enjoy momentum to restore while the specific increment depends on the regulation of energy consumption.

In long run, demand for textiles and apparels mainly relies on export in 2021. As for the grand tendency, exports of textiles and apparels have peaked in China and started falling slowly. The Sino-US trade negotiation should be noted in short run. Domestic demand is expected to turn thinner in Nov-Dec. It is suggested to pay attention to the export orders for spring wear. Whether falling sea freight recently will favor the placement of export orders? In terms of supply side, the production curtailment resulted from the energy consumption regulation should be concerned. Supply and demand status will be reevaluated according to the actual implementation of policies.

With weak demand and firm cost, stocks of the whole value chain are likely to accumulate again if the run rate of upstream market rises after the regulation of energy consumption mitigated. However, price of downstream market may be hard to track the uptrend on feedstock market if demand weakens. If the control of energy consumption remains strict, stocks of the whole value chain are likely to reduce and price is expected to rise.