Name:HENAN GUANGDA TEXTILES IMP. & EXP. CO., LTD.

Add:10/F,XinMangGuo Building,No.9 Business Outer Ring Road,ZhengDong New District,ZhengZhou,China

Tel:86-371-60170260

Fax:0371-60136222

Postcode:450000

Web:www.hngdtex.com

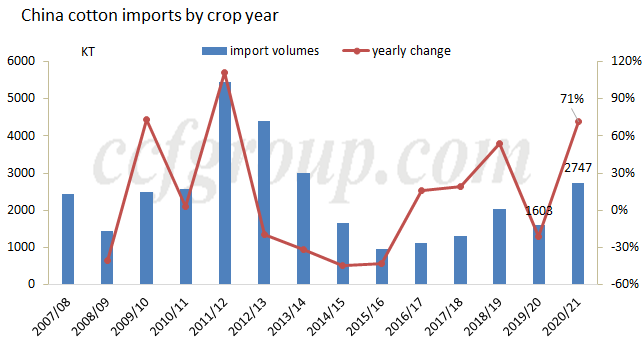

In 2020/21 season (Sep 2020 to Aug 2021), China imported 2.7466 million tons in total, an increase of 71% or 1.14 million tons year on year. Import volumes of U.S. cotton exceeded one million tons, with a proportion of 44%. The cotton export volumes were 2.5kt during the same time, down 90.2% year on year.

2020/21 China cotton import analysis:

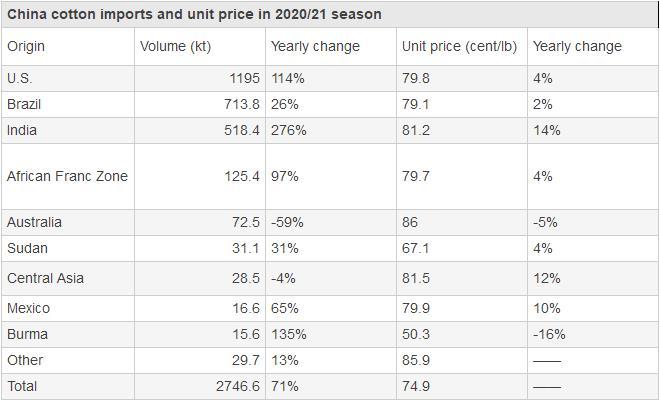

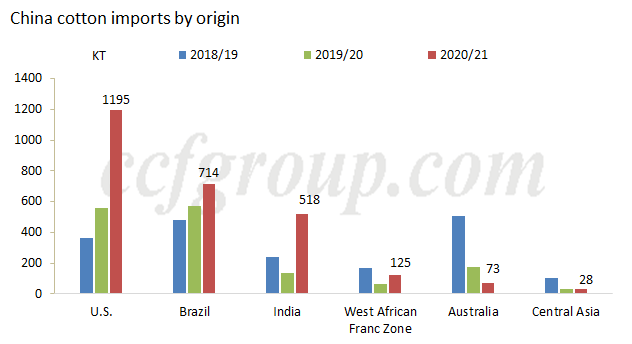

In 2020/21 season, China mainly imported U.S. cotton, Brazilian cotton and Indian cotton. U.S. cotton imports reached 1.195 million tons, up 114% year on year or an increase of 0.64 million tons. In addition, imports of Indian cotton rose significantly, a year-on-year increase of 276%. Imports of Brazilian cotton took the second place, while the growth rate was mild. However, imports of Australian cotton declined obviously by 59% year on year, mainly due to the relations between the two countries.

Viewed from the import origins, U.S. cotton was benefited from the first phase trade agreement. In 2020/21 season, the U.S. cotton imports of China doubled, and Brazilian cotton imports saw steady growth. Imports of Indian cotton also rose obviously as Cotton Corporation of India better quality cotton and prices had advantages previously. Australian cotton imports reduced apparently.

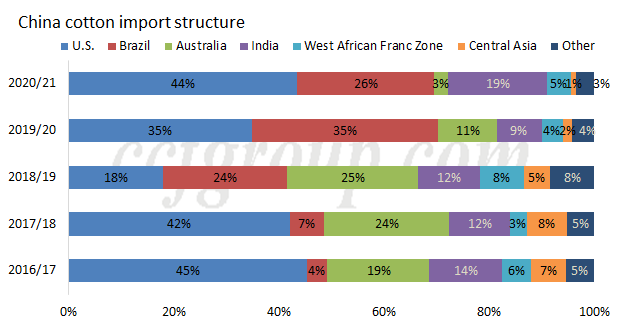

In terms of the import origins in recent five seasons, the proportion of U.S. cotton returned to the proportion before the Sino-US trade war, while proportion of Brazilian cotton increased gradually and tended to be stable, to be one of our major origins. However, the proportion of Australian cotton shrank largely.

In terms of the trade of terms, it has no big change compared with 2019/20 season.

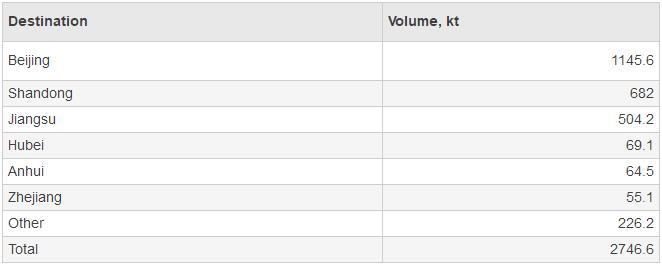

For the imports by destination, the top three provinces were Beijing, Shandong and Jiangsu in 2020/21 season.

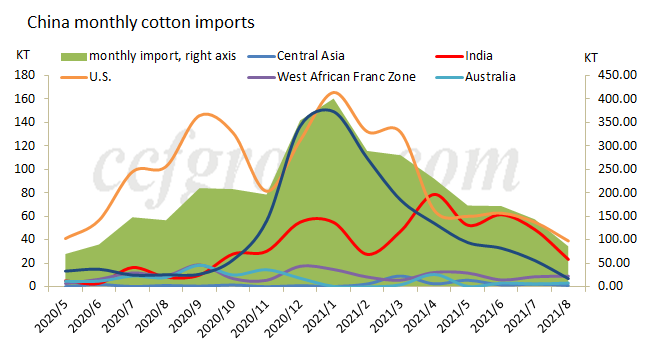

For monthly cotton imports, imports of U.S. cotton and Brazilian cotton were large before Mar, 2021, and then reduced gradually. In recent two years, the intensive arrivals of Brazilian cotton were from Dec to Feb. For U.S. cotton, the sales in 2021/22 season were later compared with 2020/21 season, so the peak arrival time for U.S. cotton in 2021/22 season may be delayed somewhat. As China National Cotton Group Corporation and Chinatex Corporation mainly imported U.S. cotton in recent two years and could not use quotas, so the import volumes of cotton were much higher than the volumes of quotas. In 2021, the sliding-scale duty quotas are only released 700kt, including 400kt for processing trade quotas, so other imported cotton through marketization is blocked somewhat at ports.

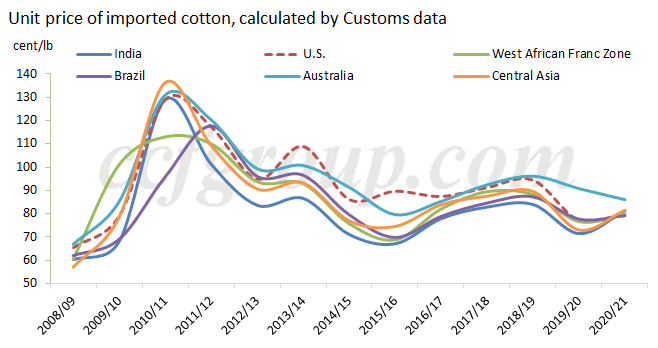

Viewed from unit price of imported cotton, the prices among the major imported cotton has narrowed obviously, and the unit price of Central Asian and Indian cotton was even higher than that of U.S. and Brazilian cotton, and the price spread of Australian cotton with other cotton also narrowed apparently.

Conclusion:

China imported 2.7466 million tons of cotton in 2020/21 season, up 71% or 1.14 million tons year on year. Imports of U.S. cotton were 1.195 million tons, an increase of 114% or 0.64 million tons. The first phase trade agreement between China and the U.S. has not ended, and in the rest months of 2021, China still needs to import U.S. cotton. It is expected that U.S. cotton will still be the major import origin in 2021/22 season. But restricted by the cotton quotas and not positive anticipation for the late consumption, cotton imports in 2021/22 season may be lower than that in 2020/21 season.