Name:HENAN GUANGDA TEXTILES IMP. & EXP. CO., LTD.

Add:10/F,XinMangGuo Building,No.9 Business Outer Ring Road,ZhengDong New District,ZhengZhou,China

Tel:86-371-60170260

Fax:0371-60136222

Postcode:450000

Web:www.hngdtex.com

Halfway through August, which is supposed to be a peak season for yarn sales, but spinners haven’t seen any sign of good sales yet. Yarn mills cut their production in a large scale, the stocks of finished products remain high, and losses are hard to turn around. Against such backdrop, peak season is out of reach.

1.Stocks accumulated fast while O/R continued the downtrend

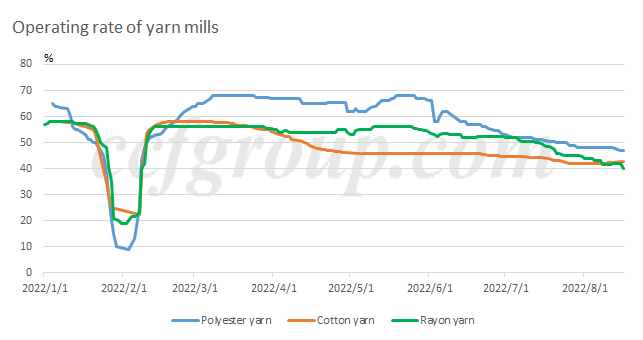

Generally speaking, yarn mills basically maintain high operating rate except during the spring festival holiday, or the forced shutdown by the pandemic or power rationing. Yet unlike previous years, there is successive decline of operating rate among yarn mills this year. The operating rate of cotton yarn dropped evidently in Mar and Apr, and polyester yarn and rayon yarn saw large production cut during Jun and Jul. The power rationing policy starting from the end of July had little impact on spinners. The fundamental reason for production cut lied in the sluggish sales and high stocks.

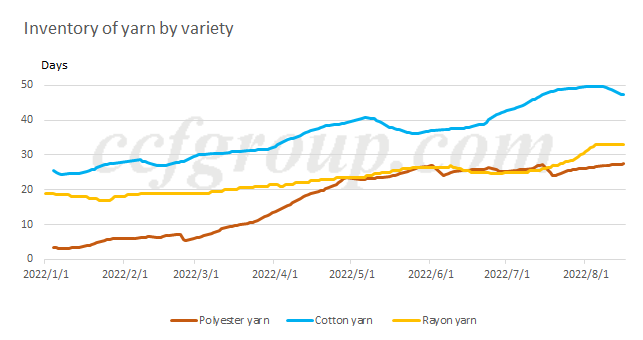

From chart 2, we can see that inventory of all finished yarns was on the rise in 2022, and currently it was in a high level since the outbreak of COVID-19 in 2020. Recently, trades of cotton yarn turned better slightly. However, overall sales were thin without substantial improvement. Polyester yarn inventory was rising steadily, while the inventory growth of rayon yarns was under control after the implementation of power rationing. All in all, the inventory of 100% cotton yarn already reached the inflection point, while the turning point for polyester yarn and rayon yarn hadn't appeared yet.

2. Cash flow under pressure, yarns at continuous losses

The high inventory was followed by fund pressure for yarn mills. Thus yarn prices continued to decline, and losses become more frequent.

The cash flow turned positive since late Jun due to the drop of cotton price from more than 20,000yuan/mt to 15,000yuan/mt. However, the using of high-priced cotton, coupled with price drop of cotton yarns had caused expanded losses for spinners. The cash flow fell to low level again as mills had run out of high-priced cotton in August and cotton yarn prices tended stable, with cotton price rebounded to over 16,000yuan/mt. 100% cotton yarn well-deserved "the most tragic yarn" in 2022.

The feedstock replenishment of polyester yarn usually lasts within half a month, and spot cash flow could basically reflect the situation of actual profit. From May till now, polyester yarn mills have suffered losses for 3 months, with cash flow staying negative at around -300yuan/mt for most of the time. Production cut was continuously seen during this period. On Jul 16, yarn association in Changle called on production cut by 50%. So far, the operating rate of polyester yarn was reduced to 47%, 21% lower than the high level during the year. Obviously, the production cut was inadequate given the sluggish sales, and the losses of polyester yarn hadn’t see any improvement.

Rayon yarn cash flow turned negative since April. And the feedstock inventory of yarn mills was maintained at 50-60days for a long time due to the trading ways of VSF. Considering the time lag, the losses of rayon yarn actually started from the beginning of Jul, and the operating rate declined sharply since then. So far, rayon yarns suffered the largest losses among pure yarns. Other yarns such as blended yarns, hemp grey yarns and colored yarns were also at losses.

3. Consumption remains slack, peak season may out of reach

The power rationing policy in Jiangsu and Zhejiang is expected to loosen given the drop of high temperature by the end of Aug. As downstream operating rate rebounds, orders are supposed to grow for yarn mills. The most expected domestic selling period is the e-commerce season in Oct-Dec, and “Double 11” shopping carnival has the largest discounts. Thus, the peak season for yarns will start in September at the latest. Market players currently hold pessimistic sentiment, and downstream enthusiasm for stocking is not that high. Month-on-month growth is about to improve, yet without strong expectations. To finish stockpiles is already hard enough for yarn mills, not to mention the signing of large amount of contracts which could last to the next season like previous years.