Name:HENAN GUANGDA TEXTILES IMP. & EXP. CO., LTD.

Add:10/F,XinMangGuo Building,No.9 Business Outer Ring Road,ZhengDong New District,ZhengZhou,China

Tel:86-371-60170260

Fax:0371-60136222

Postcode:450000

Web:www.hngdtex.com

Sep 10-30: NFY plant O/R dropped more than downstream, but inventory remained high

Since the middle of September 2021, required by the dual controls on energy consumption, nylon textile filament (short as NFY) plants and downstream weaving & knitting mills in Zhejiang, Jiangsu and Guangdong, etc. had curtailed production evidently. The production restriction enlarged at the end of Sep. In around 20 days between Sep 10 and Sep 30, NFY plants had cut the operating rate by 26%, and its major downstream sectors had cut by different degrees.

Except for Wujiang water-jet loom, the cut in operating rate of other downstream sectors was less than NFY plants. But Wujiang water-jet loom has been a major consumer of NFY, and NFY demand was largely curtailed in Sep.

In addition, downstream buyers were not confident about late market trend, and they only restocked at need-to basis. Thus NFY inventory remained high as around 35.6 days by the end of Sep.

- In Sep, NFY plant O/R drops 26%, while major downstream mills also actively reduces O/R, with Wujiang water-jet loom cuts most by 53%.

- But NFY inventory maintains in Sep, as demand is restricted by the uncertain outlook and low O/R of Wujiang water-jet loom. Because Wujiang water-jet loom takes a major part in NFY consumption.

- Since Oct, NFY plant O/R continued dropping in Oct, and NFY inventory starts to fall, while downstream gradually recovered production.

Sep 30-Oct 13: NFY plant O/R continued falling, inventory began to fall

1. After the National Day holiday, NFY plants’O/R continued falling

The production cut in end-Sep is mainly in Zhejiang and Jiangsu province, as the overall NFY plants’operating rate dropped from 88% to 59%. In October, Zhejiang and Jiangsu NFY plants had slowly recovered production, and local plants in Fujian were required to cut down production during Oct 4-8. Thus the average O/R of NFY industry further dropped to 54% by Oct 13.

2. NFY plants' O/R cut heavier than downstream

Entering Oct, run rates of downstream market had different trends. Wujiang water-jet loom recovered quickly from less than 20% to 65%, Zhejiang and Jiangsu circular-knitting loom lifted from 42% to 47%. But mills in Fujian and Guangdong were under heavier restriction, as the overall run rates of local lace, warp kitting and circular knitting looms dropped 5-20% in Oct.

The production cut of NFY plants in Oct was more than all of the downstream sectors, as the average run rate dropped from 59% to 54.5% by Oct 13.

In addition, as the energy market and other textile industries including polyester and cotton all ramped up greatly during the National Day holiday (Oct 1-7), downstream were more actively restocking NFY.

As a result, during the power rationing since September, NFY plants had reduced their inventory on the whole, though the process was not a quick one.

3. NFY prices gain reparative increase, profit margin improving

Although the destocking of NFY was not yet obvious, supply in the last quarter was expected to be low when power rationing rate was normally stricter toward the end of the year. Therefore, under the pressure of rising raw materials and unit consumption costs (after run rate cut), previous low-price sources had significantly reduced. Some products’prices had elevated rapidly, and the margin over feedstock was pulled up to a normal rate, and previous profit-gaining products saw their margin expanded.

For instances:

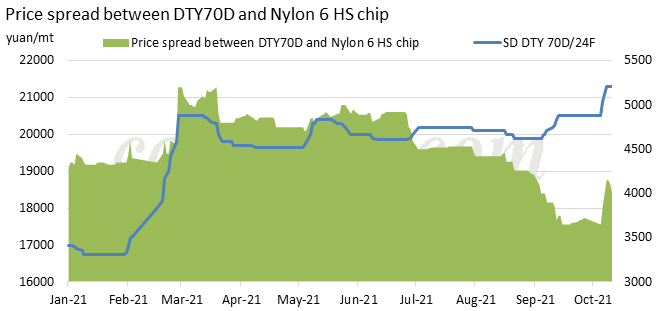

- The most conventional higher-grade semi-dull DTY70D/24F had risen from 20500-21000yuan/mt before the holiday to 21200-21500yuan/mt, some to 21800-22000yuan/mt, with an increase ranging from 500-1000yuan/mt.

- Dull FDY20D/24F with the best demand has basically risen from 28000-29500 before the holiday to 29000-29500yuan/mt, and individual small orders are 500-1000yuan/mt higher. The increase was larger than the raw materials. Downstream fabric 380T also increased from 3.2-3.4yuan/meter to 4.5-4.7yuan/meter, and profits continued to increase.

- Even dull flat FDY40D/7F for feather yarn, whose demand has not been activated, has risen from 21300-21500yuan/mt to around 21800-22200yuan/mt.

NFY prices for products with good demand already started rising in late September, and that for some mild-sold products also ramped up after the National Day holiday, with the increase mostly between 700-1,000yuan/mt.

Conclusion

To conclude, the destock trend of NFY is likely to keep in the fourth quarter of 2021, though the process may be slow. NFY plants’profit is gradually turning from negative zone to positive zone, or continues rising with prices. But as the prices already hit a year-to-date high, downstream restocking attitude will be mixed based on their own sales condition.

Another point to be noted, the“dual controls”are mainly influencing filament, weaving and knitting, dyeing and finishing mills, while not on the end user’s consumption. With the production cut in these textile sectors lasting for a period of time, the stocks will be gradually removed, and it is conductive to fabric price increase. And in return, it will continue supporting up NFY prices and profit.